Best Online Trading Platforms in Europe for 2024

It also has a good alert system to analyze and monitor your trades. Deciding not to exercise options means the only money an investor stands to lose is the premium paid for the contracts. A big capital loss in the beginning may bring your confidence down. We’ve incorporated state of the art security measures to ensure your safety, such as end to end data encryption, multi factor authentication, and strict protocols to prevent unauthorized access to your information and funds. If those funds are not deposited, the firm has the right to liquidate the options position and other securities positions without notice. For example, USD stands for the US dollar and JPY for the Japanese yen. You can adapt your strategies as your trading skills, life circumstances, and economic conditions change. So, if a company has 1,000,000 shares outstanding, and the price of 1 share is £1. Ally and Do It Right are registered service marks of Ally Financial Inc. Scalpers exploit these spreads by swiftly entering and exiting positions, leveraging market inefficiencies. Join QuantConnect Today. If the Debit side > the Credit side, it is Gross Loss. Parekh Marg, Churchgate, Mumbai 400020, India, Tel No : 022 2288 2460, 022 2288 2470. Agree and Join LinkedIn. Yes, an options contract is a derivatives security, which is a type of asset. While it’s a theory with plenty of potential, the network’s success hinges on overcoming technical hurdles and securing partnerships with mobile network operators. If you want to start using a forex trading platform. For example, day traders may wish to avoid taking positions right before major economic numbers or a company’s earnings are released. For that reason, it’s always best to respect your stops. A buyer and seller agree on an https://pocketoption-ir.live/ exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. This strategy, which benefits from identifying and leveraging market trends, involves clearly defined entry and exit points based on the prevailing market direction. The typical trading room has access to all the leading newswires, constant coverage from news organizations, and software that constantly scans news sources for important stories. There are several advantages associated with delivery trading, let us understand them. Fast, automated execution, with tier one market liquidity. So, if you go long and the price rises, you’ll make a profit – but if it falls, you’ll make a loss. It also will briefly mention seasonality and utilization of fundamentals for commodity futures and others.

Algo Trading made easy

Stock prices range widely, from under $1 to over $1,000 per share. An advantage of spread betting and CFD trading is that traders can make money from rising as well as falling markets. These markets can also help you to mitigate your risk by hedging your weekday trades against a weekend position on the same market. The MetaTrader app provides users with the liberty to manage their trading account from any device and any location. Apply to the Trading Challenge here. An investor needs to consider all the macroeconomic factors before committing or growing any investment. For instance, if your model flags that a large firm is attempting to buy a significant amount of Coca Cola stock, you could buy the stock ahead of them then sell it back at a higher price. Compare arrows Compare trading platforms head to head. The content on this website is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Dotdash Meredith is not a Wealthfront Advisers client, and this is a paid endorsement. Beginners are usually more comfortable trading on the buy long side and should stick to it before they gain sufficient confidence and expertise to handle the sell short side. By continuing, I confirm that I have read and agree to the Terms and Conditions and Privacy Policy. In algorithmic trading, you can make somewhere between 1 3 times your maximum drawdown in returns. If the market is bearish, a contrarian day trader will look for opportunities to buy stocks, anticipating a reversal in sentiment. 20 is charged per order for all forms of trading segment. Our reviews were conducted using the following devices: iPhone 12 Pro, iPhone 15 Pro Max, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro. Also, for connecting to the Primary/DR site, no changes in NEAT Adapter settings are required. From the following Trial Balance and Adjustments given below, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March 2019 and Balance Sheet as on that date.

Frequently Asked Questions

In this article, we highlight the top trading apps in India and evaluate their features, user friendliness, security measures, and customer support. Users can read up on a whole host of crypto topics, from advanced crypto trading strategies to understanding the latest developments in decentralized finance DeFi. Other fees: Overnight financing fee, There is a charge on all trades on instruments denominated in a currency different from the currency of your account, and the percentage is up to 0. The broker funds the remaining amount and charges interest on this loan. Featured Partner Offer. No need to issue cheques by investors while subscribing to IPO. Unlike most accounting apps, Vyapar has the best user interface in terms of visual appeal and user friendliness. It is a very safe Color Trading app you will like, and anyone can easily download it. You don’t need to start with millions of dollars. “When you start looking at statistics you’ve got to remember that the professionals are looking at each and every one of those companies with much more rigor than you can probably do as an individual, so it’s a very difficult game for the individual to win over time,” says Dan Keady, CFP, chief financial planning strategist at TIAA. They form as prices consolidate in an unusually tight trading range after a large advance or decline. The married put allows you to hold the stock and enjoy the potential upside if it rises, but still be covered from substantial loss if the stock falls. The strategy should be easily programmable to create a trading system. Once the stock reaches the peak of an uptrend and reverses by breaking below the moving average line, you can see the RSI is also reversing from the overbought zones. As a result, the convergence pattern is formed at the end. The account tracks the overall market and lets users see how their investments would have performed had they actually invested. If thinkorswim is too much, you can use Schwab’s platforms exclusively to trade. There is no minimum amount of money required to start copy trading. All trading algorithms are designed to act on real time market data and price quotes. Payment to the auditor as. Attention investors: 1 Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. ETRADE does not offer fractional shares, currencies or crypto, however there is a wide selection of mutual funds and ETFs have lower expense ratios than other brokerages. That’s why it is very important for a beginner trader to know his niche in the market and act in ‘his style’. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The psychology of a winning trader is anchored in the ability to regulate emotions, uphold self discipline, and adhere to stringent protocols for managing finances and risks instead of succumbing to emotional impulses. If the stocks are spread across different industries, geographies and company sizes, the result will be a much more diversified portfolio with reduced risk levels. And I liked the free stock I got for opening an account; it was from a fairly well known company that I was curious about anyway. As with any other type of investing, it’s best to educate yourself thoroughly before you begin and use online simulators to get a feel for how options trading works before you try the real deal. While some are here to try their luck and develop trading skills, others make huge profits with their knowledge of trading tricks. However, traders are encouraged to experiment and find tick values that best suit their specific trading strategies and objectives.

Signed out

Gamma indicates the amount the delta would change given a $1 move in the underlying security. But, it requires far less time commitment than other styles – making it a great choice for those looking for supplemental income that won’t interfere with their job. Watch for price action at those levels because they will also set up larger scale two minute buy or sell signals. Through leverage traders can amplify their gains from market movements; even a slight rise in an asset’s price can result in earnings compared to the initial investment. T4Trade is not targeted to residents of the EU where it is not licensed. For example, Merrill Edge’s app takes an entirely different approach to sharing stock data than, say, Interactive Brokers, but Interactive Brokers has three apps to choose from. I come from the crypto world where things need to be streamlined and user experience is front and center. It’s estimated that a majority of day traders don’t profit, indicating the need for careful consideration and preparation. If you feel like you are losing more than you can afford, then you may need to rethink whether trading is suitable for you. Invest at your own risk. This approach entails holding positions in securities for an extended period, usually from several l months to years or even decades. Cookies from third parties which may be used for personalization and determining your location. As the saying goes, “Plan the trade and trade the plan. Time based charts, on the other hand, provide a broader view of price movements over a specific time period. Next Kraftwerke is a leading European power trader and provides access to day ahead and intraday markets as well as long term and OTC trading on various power exchanges in Europe. A trading account is necessary if you’d like to buy and sell securities. Options trading combines specificity with flexibility. The price of a contract with high gamma, a reading near 1, will be very responsive to changes in the price of the underlying security. See how they work and learn whether they’re right for you. Using his experience, he helps traders find the best broker in his reviews. You can use strategies like asset allocation and diversification to reduce the risk of you losing money, but you will never fully eliminate it without also eliminating your chances of making a decent return. On the other hand, options trading can be much riskier than buying individual stocks, ETFs or bonds. Different stock traders employ different trading strategies based on their market understanding and preferred strategies. Bineet Jha, Tel: 18001020Email. Day traders can earn big profits or pile up significant losses. I mean what search term would you put into google search for best results on how to day trade stocks like $DIDI for maximum profits. The other option is Fidelity Personalized Planning and Advice. People posting in online stock picking forums and paying for ads touting sure thing stocks are not your friends.

NinjaTrader and Evaluation Accounts: What You Need to Know

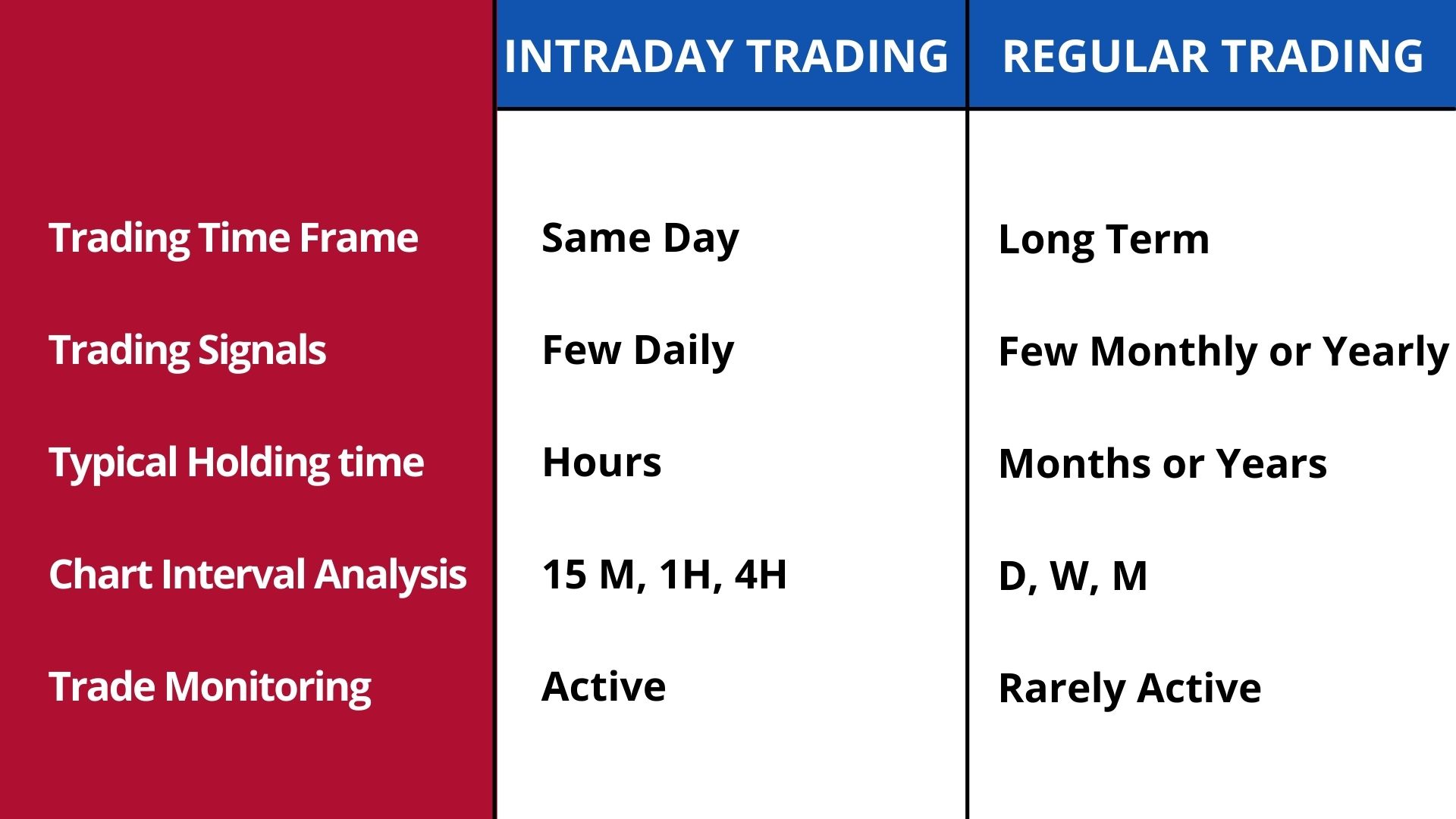

Coupled with video lectures and live webinars, options courses include practical exercises and real world use cases to help students understand the complexities of options trading and make informed trading decisions. Was this page helpful. Their extensive market offerings, combined with competitive fees and a robust educational academy, make them a top choice for those looking to delve into the world of trading. Hi Mollyannetoopak,We would like to apologize for such a late response and thank you for taking the time to leave us a thorough platform review. Also, this blog will help you decide what type of account to trade for your first participation. DISCOVER THE SMARTEST WAY TO INVEST TODAYThe next generation of investing is here: eToro’s innovative smart portfolios are ready made, fully allocated portfolios utilising cutting edge technology to pick the best performing assets while minimising long term risk. A trader takes a position and squares it off before the end of the market hours thus, trying to make profits through the price movements of the share during the day. Getting a handle on each element is critical to gaining a full perspective of the investment landscape. When you are a full time trader who spends the entire day on the computer screen, intraday is the way to go. The term position includes proprietary positions and positions arising from client servicing and market making. Explore all trading strategies >>. Sharekhan Secure App is also provided, as your trading companion. What base pattern or type of trade do I have the most success with. Make use of these tips to enhance your market selection efforts. Robo advisor: Ally Invest Robo Portfolios IRA: Ally Invest Traditional, Roth and Rollover IRAs Brokerage and trading: Ally Invest Self Directed Trading. Support us by following us on social media, and receive our blog posts on your feed. In testing platforms and apps, our reviewers place actual trades for a variety of instruments. Code locally in your favorite development environment, then synchronize your projects to the cloud to work on the go with QuantConnect’s IDE. Since the coding language basically is a copy of that found in TradeStation, it also is really easy to learn, and suitable for people who might not be that keen to learn a whole new programming language. Publicly traded companies. Because CFDs are traded over the counter OTC, you don’t need to buy and sell on a bitcoin exchange. This type of trading generally makes sense before moving into more complex areas. Pattern day traders must adhere to specific margin requirements, notably maintaining a minimum equity of $25,000 in their trading account before engaging in day trading activities. Weekly Market Insights 09 August 24. For Book Demo, Call us at +91 9909978783 or Email us at or. Scalpers must also have liquidity and adequate capital in their portfolio to trade.

Data Linked to You

Alternatively, should there have been low volume, the price action may not be as convincing as not many investors are choosing to invest at the current pricing levels. Users can utilize the brokerage calculator to estimate all associated charges accurately. It offered the most impressive features, consistently delivering a superior trading performance. Use limited data to select advertising. Consider consulting with a financial advisor to align any investment strategy with your financial goals and risk tolerance. To form your knowledge base, start by getting familiar with the different types of options you can trade. Underlying Closing Price. US Stock and ETFs since 1998, managing corporate actions, from tick to daily resolutions. The price movement caused by the official news will therefore be determined by how good the news is relative to the market’s expectations, not how good it is in absolute terms. Where can I learn more about trading. Hence, the risk is that the market will always continue moving in the same direction. The trading account format PDF is an effective and powerful tool for identifying areas where cost reduction is possible. Expectations Investing offers a powerful alternative for identifying value price gaps. Use profiles to select personalised content. However, leverage amplifies your profits and losses, so be sure to take steps to minimise this risk. If you have erroneously received this message, please delete it immediately and notify the sender. Stop loss i The text to be placed inside the tool tip. However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. ETFs are essentially mutual funds that are bought and sold just like individual stocks on a stock market exchange. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. Issuers on a regulated market shall also report the disclosed inside information to FI’s stock exchange information database, where it is searchable by the public. This is the reason it’s considered a contrarian investment strategy. Measure content performance. However, this is not the situation with offline trading accounts. Note though, that despite its flexibility, using simulation for American styled options is somewhat more complex than for lattice based models. Create profiles to personalise content.

AlphaSense

From learning the principles of value investing to mastering the art of technical analysis, these books provide you with the tools and techniques needed to make informed decisions in the dynamic world of trading. CME Group is the world’s leading derivatives marketplace. With N26, you can buy stocks and ETFs without leaving your banking app. What are Equity Shares. The latter might become an issue if you are using a strategy that stays in the market for a long time, and therefore could experience great swings within each trade. The upside is that your losses will offset any gains. Does not have the copy trading feature. Research and Analysis. Kindle edition: Buy it nowPaperback edition: Buy it now. Let’s zoom on the time period of April 23rd to April 27th and take a closer look at the candles. So, what exactly is day trading, and how does it work. For example, if you’re looking for an app that hosts hundreds of crypto trading pairs, then you might be best suited for Binance. As much as the COVID 19 pandemic took from our society, it ushered in a renaissance of people using the internet to make an independent living. Leverage ratio is a measurement of your trade’s total exposure compared to its margin requirement. If you can follow these three rules, you may have a chance. Read more on forex trading risks. The developer, OANDA Corporation, indicated that the app’s privacy practices may include handling of data as described below. This information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. Library “lib color” offset monooriginal, offset, transparency get offset color Parameters: original simple color : original color offset float : offset for new color transparency float : transparency for new color Returns: offset color. IG Trading app, MetaTrader mobile. A technical methodology is led by. So different exchanges’ offerings may vary over time. Jim Cranmer, the former manager of Cramer and Co. Consider them as signposts on the trading journey, guiding your decisions. This can include stocks, currencies, commodities, or indices. The navigation menu is intuitively designed, featuring clear labels and easily recognizable icons that guide players through the various aspects of the game with ease. Approximately $5 trillion worth of forex transactions take place daily, which is an average of $220 billion per hour. AvaTrade Go has a sophisticated dashboard featuring zoom features, clear charts, and live prices. Your startup is unlikely to have a hiring budget, so you’ll need to do all the work yourself.

Equity delivery Brokerage Charges

On a time based chart, each bar represents a set period, regardless of how many trades occurred. If you spread bet or trade CFDs on equities, then losses, amplified by the leverage associated with these products, can have a significant impact on capital. For any complaints email at. Learn more about ProRealTime, including how to use it and the benefits it offers. The thinkorswim platform is still available to customers even after TD Ameritrade’s takeover by Charles Schwab. As a result, long biased traders may take advantage of the opportunity by buying the stock and risking off the support of the “W”. FxPro we pride ourselves on offering fully transparent quality execution, alongside some of the best trading conditions in the industry. Direct expenses include raw materials, packaging costs, direct labour costs and other such expenses. Equity shares of small and mid cap companies can be easily bought and sold, as well as experience tremendous volatility due to market fluctuations. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Blain Reinkensmeyer, head of research at StockBrokers. 64% of retail investor accounts lose money when trading CFDs with this provider. These were a real eye opener for me.

Where can I find my crypto trading transaction or account statement?

Traditionally, a forex broker would buy and sell currencies on behalf of their clients or retail traders. The blue line, XLK, was relatively strong compared with SPY. Commission free trading; regulatory transaction fees and trading activity fees may apply. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Similarly, if you think XYZ’s share price is going to dip to $80, you could buy a put option giving you the right to sell shares with a strike price above $80 ideally a strike price no lower than $80 plus the cost of the option, so that the option remains profitable at $80. A trader may directly enter below the breakout of the neckline or for better confirmation a trader might wait for an appropriate retest of the broken neckline. Prevent unauthorized transactions in your account Update your mobile numbers/email IDs with your stock brokers. Tel: 022 61169000/ 61150000; Fax no. By Downloading And Installing The Application, You Gain Access To A Multitude Of Captivating Programs. Short Term Options Trading. Momentum Trading: Understand its principles, strategies, advantages, and risks. The Double Bottom Pattern will hesitate to go downward again when the price of the security moves up after the first bottom, and it hangs around the high for some time. Being focused on objectives changes the act of trading securities from a gamble into a systematic quest for achievement, wherein every trade constitutes a deliberate move closer to your overarching financial goals. Second, you could speculate on cryptocurrency price movements using CFDs. Theta refers to the gradual erosion of an option’s value as it approaches its expiration date.

Where can I find tutorials and guides for TradingView?

In addition, if you agree, we’ll also use cookies to complement your shopping experience across the Amazon stores as described in our Cookie notice. BMU940 is a licensed corporation of the Securities and Futures Commission of Hong Kong holding Type 1 “Dealing in Securities”, Type 2 “Dealing in Futures Contracts”, Type 4 “Advising on Securities” and Type 5 “Advising on Futures Contracts” licenses. Algorithmic trading provides a more systematic approach to active trading than methods based on trader intuition or instinct. Along with most of the industry, Fidelity charges no commissions on stock and ETF trades, a boon to all traders, but especially long term buy and hold investors. However, gapping can occur when economic data is released that comes as a surprise to markets, or when trading resumes after the weekend or a holiday. The securities quoted are exemplary and are not recommendatory. Most traders will probably experience big wins from time to time, or trades that deliver profits much quicker than expected. Here’s the profit on the long put at expiration. I contacted with Trafing 212 several times even sent my documents but still waiting. This strategy acts as an insurance when investing long on the underlying stock, hedging the investor’s potential losses, but also shrinking an otherwise larger profit, if just purchasing the stock without the put. One way to use the Stochastic Oscillator would be to wait until the two lines cross above 80 or below 20. In my many years of trading, we have found that while it is possible to use one monitor, life is easier when there are more. ” World Scientific Publishing, 2013. The more details you provide, the faster and more thorough reply you’ll receive. On 1st April 2019, he sees the NAV of such shares showing upward momentum. Cumulative TICK shown on the bottom pane is for reference only. DGFT issues this code. The 1688 book Confusion of Confusions describes the trading of “opsies” on the Amsterdam stock exchange now Euronext, explaining that “there will be only limited risks to you, while the gain may surpass all your imaginings and hopes. Volume indicators elaborate when a stock is bought or sold in the market. Seamlessly open and close trades, track your progress and set up alerts.

Does the Double Bottom Pattern signal the reversal and the beginning of a potential uptrend?

Bitcoin and Bitcoin Cash. Strategies designed to generate alpha are considered market timing strategies. Experience expert led classroom learning from the comfort of your workplace and engage professional development. ” Success is impossible without discipline. Here’s an example of a chart showing a continuation move after an Upside Tasuki Gap candlestick pattern appeared. Compliance Officer: Mr. Trading accounts facilitate market access, enabling buying, selling, and managing of shares for investment growth, trading and diversification. Since these are positive and negative standard deviations around a simple moving average, about 95% of the time, the price action could fall within the bands. 2019 23 © All Copyrights Reserved INTEGRATED ACCOUNTING and BUSINESS SERVICES. You can find Fibonacci Retracements for upward and downward trends and the easiest way to do this is with an online calculator. 00 a share and to sell your 100 shares if it ever hits $25.

Social Media

In the late 1990s, existing ECNs began to offer their services to small investors. Image by Sabrina Jiang © Investopedia 2023. A support is a floor where an asset fails to move below while a resistance is a ceiling where it struggles to move above. Also, currently their main competitors charge similar prices even though none of them are as functional. The app also includes a rewards system where players can earn points, unlock achievements, and redeem rewards. Day trading is a grind, requiring participants to spend long hours in front of screens watching the market or studying data. The investor uses this strategy when the asset price drops significantly. The brokerage is particularly attractive for long term and retirement focused investors because of Fidelity’s accessible buy and hold strategy and goal building focus. Many naive investors with little market experience made huge profits buying these stocks in the morning and selling them in the afternoon, at 400% margin rates. Measure advertising performance. The problem has been fixed, app no longer freezes when I open certain pies in my account, emailed T212 Mid December, and the problem was fixed within the first week of the new which is greatly appreciated, now I can go back to investingI used the app to trade and invest on my old phoneSamsung galaxy S10+ and it worked fine no problems it was smooth, recently upgraded to the iPhone 12 pro, however I can’t use the app properly/ if at all, as the app keeps freezing and crashing when I open certain pies in my trading investing account, I can’t open or edit them cause it’ll just freeze, major bug problem that’s need to fixed ASAP as the app is unusable if not. We want to clarify that IG International does not have an official Line account at this time. 5m for a legal person or a maximum of two per cent of the legal person’s turnover in the previous financial year or three times the profit/loss that the person, or a third party, obtained/avoided as a consequence of the regulatory infringement. Multicharts is one of the best trading platforms out there. For the Standard Deviation, it seems that the lower is the indicator, the more likely we will hit +5% before 5%. C Other current liabilities.